Current cost of oil

we don’t know a lot about style, but i've heard that azure may be the new black colored. And I understand that once we purchase blue, everybody else would be putting on green.

we don’t know a lot about style, but i've heard that azure may be the new black colored. And I understand that once we purchase blue, everybody else would be putting on green.

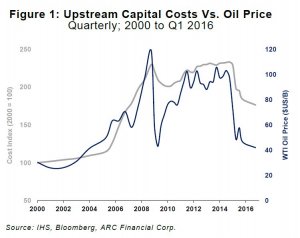

Within the oil company, modish pundits are now pronouncing, “60 could be the new 90, ” championing the thesis that productivity gains, cost improvements and cost conflicts have pulled the worldwide clearing cost of oil to $60/B, down from $90/B a few years ago.

The oilfields around the globe share some similarity to fashion ateliers.

Developers in Paris and New York collude every autumn to convince all of us to wear brand-new tints into the springtime. At the same time, innovators in Houston and cartel leaders in Vienna declare that $60 a barrel may be the brand-new, lasting marginal price of oil. Consequently, a $90-per-barrel breakeven cost is actually about since attractive to an oil buyer as a broad necktie to a millennial.

Here’s the thing: Not everybody seems good in blue and never all manufacturers possess rocks, expertise and infrastructure to help make their economic statements look proficient at $60 a barrel.

Behind the scenes, the oil industry has become much more discerning with its very own means.

If you have one brand-new style that’s apparent it's that “short-cycle” investing may be the new “long cycle.” In other words, smaller capital outlays, quicker payback and much more specific comes back have grown to be de rigour for gas and oil investing. You can forget multi-billion-dollar, decade-plus tasks which are at the mercy of the lasting vagaries of geopolitics, the threat of expropriation, corruption, municipal war, policy anxiety or straight-out obsolescence.

Like a normal navy suit, buying short-cycle jobs is a fad that’s not likely to get rid of shortly. Premier American oil areas like the Permian, Eagle Ford and Bakken tend to be favorable to drilling once the trading screen flashes $60 in New York. Therefore too tend to be comparable Canadian oil performs being becoming stylish.

Like a normal navy suit, buying short-cycle jobs is a fad that’s not likely to get rid of shortly. Premier American oil areas like the Permian, Eagle Ford and Bakken tend to be favorable to drilling once the trading screen flashes $60 in New York. Therefore too tend to be comparable Canadian oil performs being becoming stylish.

A lot more of the world’s oil resources have been in vogue too at $60/B, significantly more than there clearly was two years ago. “Half-cycle”, partly developed tasks with easily accessible infrastructure could be in business at $60 or less. And inexpensive center Eastern oil never ever is out of style – even though above-ground social costs are needs that will make a barrel somewhat more high priced.

But this is all just concept in a world that is mainly operating on excess oil inventories.

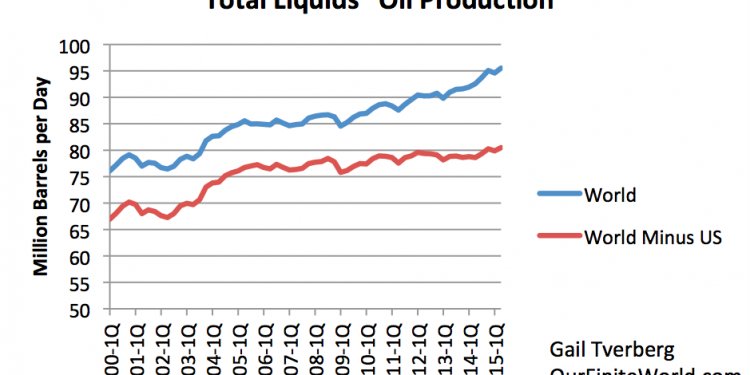

There'sn’t any field-tested evidence to claim that you can find adequate short-cycle, $60 projects to satisfy our world’s near 100-million-barrel-a-day desire for food within the next a long period. Something certain is that the location of locations where under $60 works is not as great as where $90 accustomed work.